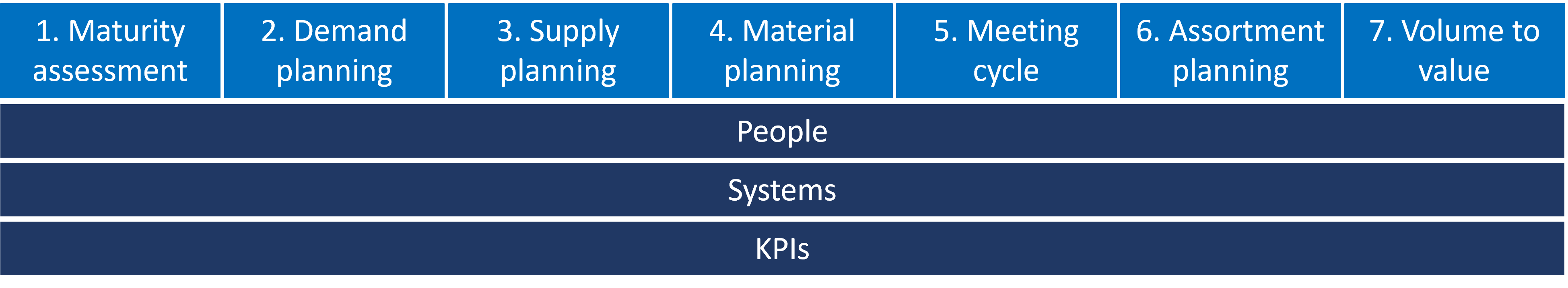

What is S&OP

S&OP is an integrated business management process through which the executive leadership team continually achieves focus, alignment and synchronization among all functions (Sales, Finance, Manufacturing, Procurement, Supply Chain, etc.) of the organization. S&OP is achieving agreement between functional areas on the best course of action to achieve the best possible balance between Demand and Supply and to meet profitability goals. S&OP ensures that the strategy is translated into the day-to-day operations and that the day-to-day operations is prepared to execute what is coming.

Step 1: Assess where you stand

Literature offers many easy to use assessment methodologies that tell you in which level you operate: there is the Gartner’s 5 stage model which is popular, Aberdeen (2010) offers a good framework and Larry Lapide’s 4 stage model (2005) is original and easy to apply. There is also Grimson and Pike (2008) which is pragmatic and clear. Any of these models is suitable to explain an organization where they are and where to improve. You can also use it to set an ambition (in time) and with that, set the goals of your project.

Step 2: Demand planning

Each planning cycle starts with the creation of the demand plan (please see “assortment plan” which comes actually before that, but this is a little bit more advanced and therefore we mention it later). The demand plan is typically created by the demand planner, who is specialized in working with the sales team to make it as reliable as possible. Statistical models can be used to translate historic data into a first version of the forecast, which can be enriched with market insights, assortment- and channel changes, etc. Although the demand forecast is typically not 100% accurate (for demand planning a so called “weighted mean absolute percentage error” of 25% and therefore an accuracy of 75% is (depending on the product-/ market dynamics) an acceptable score), the goal is to make it better and better month after month. It is important because all other plans will be based on this plan and therefore, they depend on it (the definition of “demand-driven” supply chain).

Step 3: Supply planning

Once we know what we will sell, we plan the supply (production). This consists generally of 3 parts: the master production schedule (what to produce in total per product in which production period (e.g., a week), the rough-cut-capacity-plan (do we have the capacity to produce the required production volume over the production periods), and the production schedule (which production runs, in which sequence, during a production week). The three plans are made one-by-one with each a specific function as you can see, where the last one (the schedule) is the most operational.

Step 4: Materials plan

Once it’s clear which products to produce when within the given capacity, we can calculate through the bill-of-material which (raw) materials are needed for production. After taking the inventories and inventory settings (e.g., safety stocks, lead time and more) into account, we can determine which volumes need to be contracted for the coming period and if we have access to sufficient supply.

Step 5: The meeting cycle

Once the demand, supply and materials plan are brought up to standard (or this is in process), we can install the meeting cycle during which the planners and executives come together. Initially and during the first two weeks of the month. the planners have their own meeting such as the demand meetings for the demand planners and the production planning meetings for the supply planners but the meetings during which the plans come together are traditionally the pre-S&OP meeting and the Executive S&OP meeting (during the last two weeks of the month). The pre-S&OP meeting is more detailed, the experts themselves are at the table and main relevant challenges and scenarios are discussed. Decisions are made within the mandate of this meeting. During the Executive S&OP, if needed, the CEO of the company takes final decisions that other cannot take. These could potentially be adjustments to the demand plan (because they are not feasible), or to invest in additional production capacity (temporarily or structurally).

Step 6: Assortment planning

As already mentioned, the creation of the demand plan should be preceded by the assortment plan. Because this falls within the marketing or product portfolio management domain, this area is usually harder to convince to join the S&OP cycles. Therefore we recommend to connect the processes after the basic process is in place. The goal of the assortment plan is to determine or clarify which product will be delisted and which ones will be introduced and when. This supports the demand planning process to include this information in the demand plan.

Step 7: From volume to value

A step that is also somewhat harder to take is the transition from a volume plan to a value plan (revenue). Simply said, because this additional angle will be build up by an additional data dimension: the sales price. By itself the sales price is not the most difficult of they are well maintained somewhere in the system, but if you want to move to also margin, this is harder. For this you also need to consider cost prices and the full set of applied trade terms (discounts, promotions, marketing activities, etc.). Eventually it would be the goal to drive the decision making process based on profitability, but this is a difficult stage to reach. Once it works, the S&OP process can start to also drive the budgeting process. This development is sometimes (but not always) referred to as Integrated Business Planning (IBP).

Parallel track A: People

S&OP is a process that is run by people with a scarce combination of talents: they are analytical, they understand the business, they are able to communicate smoothly and build bridges with all stakeholders. With the labor market being already tight, these profiles are highly in demand. Therefore, starting to recruit and engage these talents is a priority.

Parallel track B: Systems

S&OP is heavily supported by data and calculations. The data come from many directions and to combine them is hard. The large integrated S&OP solutions, shown in the Gartner Magic Quadrant for Supply Chain Planning Solutions, are designed to capture the required data and to combine them to support decision making. Besides these well-known, sophisticated and high-budget vendors, there are also more medium sized players on the market. Finally, the market also offers “single purpose tools” that are aimed at for example only demand planning or scheduling and can be used in an isolated way (excellent way to take first S&OP steps).

Parallel track C: KPIs

To enable fact-based performance and progress reporting, several KPIs can be installed. Most apparent examples are Service Level (orders placed vs orders delivered on-time and in-full; also known as OTIF), Inventory Level (stock snapshot in volume, value and number of days coverage) and Forecast Accuracy (previously mentioned WMAPE but also the Forecast Bias). The sooner these KPIs are in place, the better you can see the progress.

Closing comments

To build a state-of-art (level 4-5) S&OP process from scratch, including S&OP software and team, may take several years. Once the basics are in place, the new technologies mentioned in the introduction will come within reach and may be able to add value. With that, the journey will probably never stop, but the main investments are done. And they will be most certainly be lower than their benefits.